The 2025 Work Tech Bifurcation: Why the "Messy Middle" is Disappearing

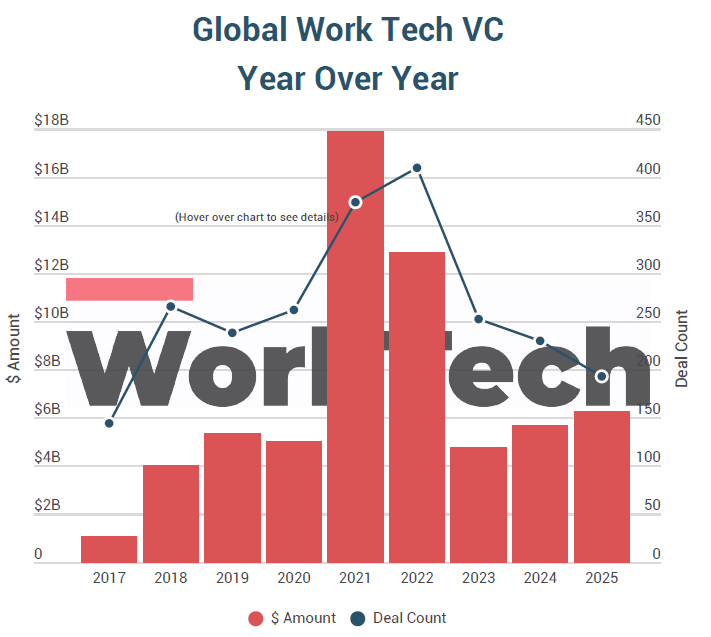

Global investment in Work Tech rose by 10.4% in 2025. But behind the $6.24 billion headline is a market ruthlessly splitting into two winners: the AI-native innovator and the category leader.

A Note on the Data: Last week, I shared some initial 2025 findings with my private Market Insider list. The response was overwhelming, confirming that the "Messy Middle" is the #1 threat on everyone's mind. Today, I’m opening up the full analysis and the specific charts that made our WorkTech refresh a strategic necessity.

Yesterday, we launched the newly clarified WorkTech brand. Today, I want to share the data that made that refresh a necessity.

In 2025, the WorkTech market matured beyond the post-AI frenzy correction of the previous two years. While deal volume fell by 16% (from 230 to 193 deals), total capital investment rose to $6.24 billion.

This "capital up, deals down" dynamic signals a market that has moved past the post-frenzy correction and entered a phase of aggressive, strategic consolidation.

You can download the comprehensive 2025 Global WorkTech Update here for a deeper dive into the raw numbers.

The Rise of the “Mega-Deal”

The story of 2025 was the concentration of capital at the top. We tracked 17 "mega-deals" (investments of over $100M). These 17 transactions alone accounted for $3.5 billion, roughly 56% of all capital invested during the year.

Investors are no longer spreading small bets to see what sticks. They are moving to consolidate the market around dominant, AI-native platforms and Workforce Intelligence.

The Data Behind the Bifurcation

For both founders and enterprise leaders, the 2025 data reveals a disappearing (and messy) middle ground:

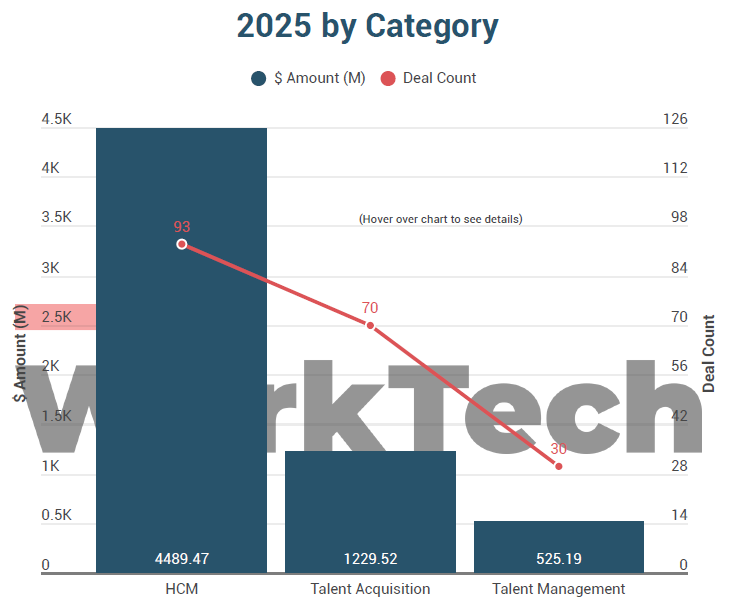

HCM Concentration: Capital is heavily concentrated in HCM suites, which accounted for $4.4 billion in dollar volume, the vast majority of the year’s total.

The Specialization Surge: While HCM suites dominate the headlines, Talent Acquisition and Talent Management remain high-conviction areas for specialized innovation.

The Flight to Quality: The trend of “extending rounds” to buy time has come to an end. It has been replaced by a “flight to quality” where providers must demonstrate clear dominance or Agentic AI capabilities to secure funding.

Building vs. Scaling: Your 2026 Trajectory

As we enter 2026, the sentiment among tech C-suites has shifted from cautious optimism to pragmatic acceleration. The goal is no longer just to survive, but to scale the AI-driven infrastructure that will define the next decade of work.

This data is why we have clarified WorkTech into two distinct tracks:

For the Builders (Seed/Pre-Seed): Early-stage innovation remains the heartbeat of the market, but it is feeling the brunt of the volume decline. To win, you must move from a “broad market idea” to a pinpointed, defensible target. Our February 10 Sprint is designed to give you the ICP and Narrative blueprints to achieve exactly that. [WorkTech Early-Stage LaunchPad]

For the Scalers (Series A+): Average deal sizes jumped to over $32 million in 2025. If you are scaling, you are either becoming a category leader or being absorbed by one. Our Growth Advisory track is focused on the strategic category leadership and M&A readiness required to win in a consolidated market. [WorkTech Strategic Advisory]

The blueprints are ready. The data is clear. It’s time to choose your lane.

-George