Work Tech Forecasted to Reach Nearly $1 Trillion by 2026

Here We Go!

As we launch into 2023, we hope the experiences and perspective you gained in 2022 will serve you well. Perspective can be a powerful thing. Having the proper line of sight can make or break any decision. Whether "zooming out" to help you see where the market is headed and build your strategy or "zooming in" to focus on a specific technology or trend for planning, we're grateful that in 2022 you turned to WorkTech for data-driven insights, experience, and perspective to help you along the way. We look forward to offering you much more of the same in 2023.

Speaking of perspective... Let's get some.

With so much uncertainty looming in the market, it's time to take off your rose-colored glasses. And when you do, please put them next to your jaded ones. H2 2022 was a rough ride for the tech industry at large. No matter what your category was, if you were impacted adversely by the economy, then your whole world felt the impact. But, as you navigate the uncertainty and a turbulent economy, experience tells us there's only one immutable truth we can share: nothing good or bad hits everyone evenly.

The tech industry at large has been hit hard by economic decline and layoffs. The Work Tech category was hit less hard. 2022, having $12.83 billion across 405 deals, was the second largest year for global VC investment ever. 2022 saw almost 3X more Work Tech VC investment than 2019 and 2020. As for 2021, it was an anomaly. 2021 was Work Tech’s biggest year, having $17.9 billion across 374 deals.

So, if 2021 was a bit of an anomaly, what would it look like if it we removed it from view?

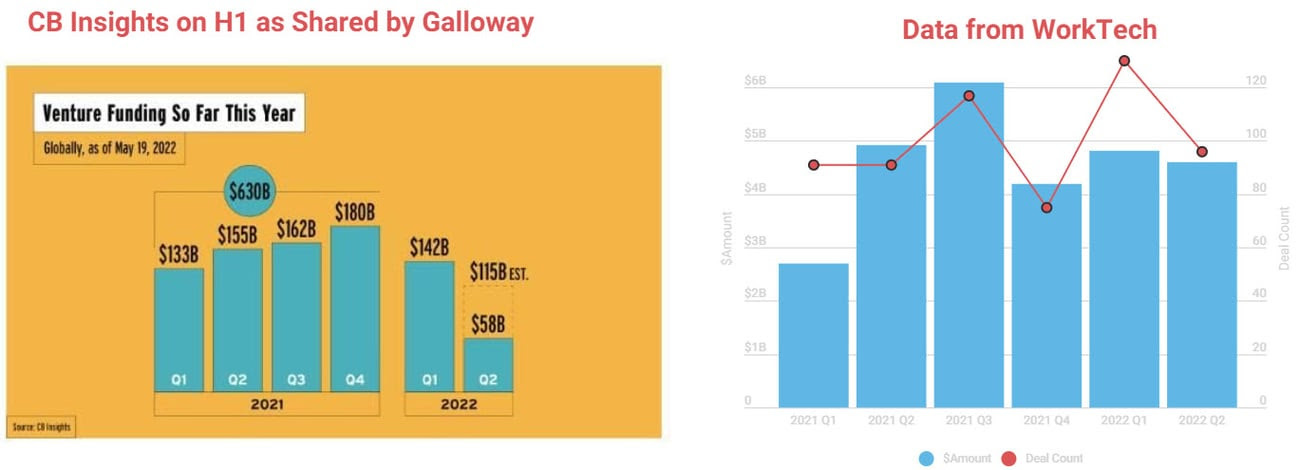

During H1 2022, while the tech industry at large saw a decline of over 50% in global venture capital, Work Tech chugged along at a record pace. The slowdown in deal pace during Q3 2022, Q4 2022, and today remain at run rate levels comparable to 2019 and 2020, previously celebrated years at $5 billion annually.

H1 2022 Comparison: VC at Large on the left compared to Work Tech VC on the right.

Where did the Global Work Tech VC Go in 2022?

2022's top five categories for VC investment were: Payroll, driven by the Employer of Record (EOR) solutions and continued expansion into new markets; Learning, driven by reskilling and internal mobility trends; Marketplace Job Boards, where innovative hybrid models continue to emerge, offering capabilities from other categories like training, workforce management, staffing, and so on; Collaboration and Communications, driven by distributed and hybrid workforce trends; and Benefits, driven by Wellness trends and continued expansion into new markets.

Compensation emerged in the top 10 categories, driven by pay equity and analytics. Staffing also appeared as service providers strive to become more tech-forward and innovators introduce new business models. Platforms and suites in HR and Recruiting held their ground as employers build tech stacks around them. Workflow automation focused on the employee experience was an interesting 11th category on the list.

Get details on 2022 VC performance, what Work Tech buyers prioritized in 2022, the outlook for adoption, budgets, and investment for 2023, and trends and predictions for the year ahead in our 2022 Look Back and 2023 Look Forward, recorded here.

Get Q4's results in our quarterly report here.

Work Tech Emerges, Nearing $1 Trillion in Market Size by 2026. Hiring Work Tech Adoption Rates, Current Spend, and 2023 Budgets Revealed

In our "New Technology Shaping the Future of Work" report, we forecast the new Work Tech category to approach $1 Trillion by 2026. Work Tech has emerged as a new category from the foundation of traditional enterprise technology categories, most notably HR technology. Not replacing HR tech but taking it into the flow of work with new employee-first design principles that drive inclusion and promise agility in anticipation of the next unknown challenge to confront the workplace.

We zoomed in on Hiring Work Tech: all the tech categories involved in finding, selecting, and hiring a company's workforce. We asked more than 1,000 international Heads of HR and Talent Acquisition about their firms' current and planned use of Hiring Work Tech. We asked what they plan to add to their tech stacks, their existing tech spending, and planned 2023 budgets across twenty-five Hiring Work Tech categories.

Market Inside Information:

The Industry's First Global Investor & Innovator Conference Launches

WorkTech is thrilled to be participating in the launch of the HR Technology Innovation Summit in partnership with the HR Technology Conference & Exposition.

As a WorkTech Market Insider, you're getting an exclusive early notice ahead of the market.Since the HR Tech conference's inception, an ecosystem of hundreds of HR and Work Tech investors of all types, tech providers of all stages - from startup to publicly traded and pre-IPO, and HR and Work Tech customers - all focused on transformative tech innovation - have attended the HR Technology Conference and Exposition on a quest to find each other. HR Tech is enabling this ecosystem with a summit where each constituency will come together to meet each other and learn.

Market intelligence and main stage content curated for this audience. Scheduled one-on-one meetings. 15-minute tech provider presentations. Access to investors from Pre-seed to Private Equity and Investment Banks.

It's happening on October 9 and 10 in Las Vegas, just before the HR Technology Conference and Exposition, and in the same venue.

As a WorkTech Market Insider, you're getting this news first. Use the link below to learn about opportunities to participate as a WorkTech provider, investor, or HR leader before the rest of the market.